(@OP) Urgh. You just complained about the teaparty people being partisan, as you cited the New York Times as a source. Urghfldargh.

You're missing the point!

(@OP) Urgh. You just complained about the teaparty people being partisan, as you cited the New York Times as a source. Urghfldargh.

(@OP) Urgh. You just complained about the teaparty people being partisan, as you cited the New York Times as a source. Urghfldargh.

That does not address the issue or problem. Simply stating that is how it works is BS. So what happens when 90% or more of the budget is just to pay the interest on the loans? Every year the cost rises and becomes a larger percentage of the budget. There are real consequences to printing more money in order to spend spend spend. If the T-Bill rates start to increase from the tiny current rate of way less than a percent to say 2 percent. or even much higher, the $383 billion we spent in 2009 will look like chump change. Take a look at the history of the T-Bill rates. We are at a historic low, if it was any lower it would be zero.. How long do you really think that will last?

Stating "All is Well" shows your inability to understand the trend and direction we are heading. Common sense is not very common in the US at all.

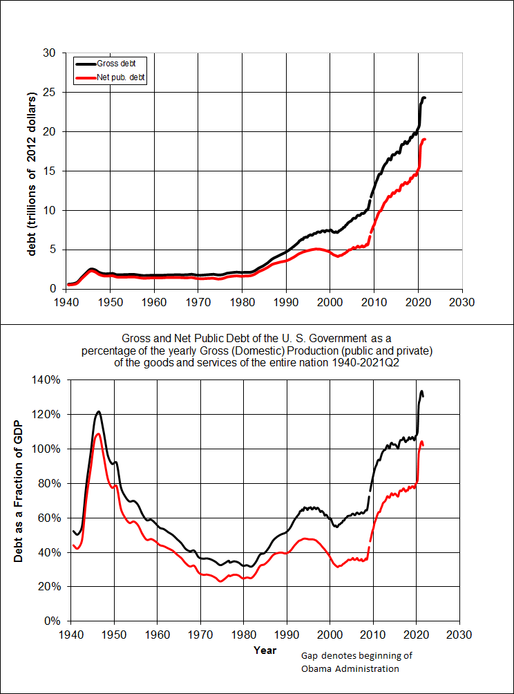

I'm sure you're aware that the debt is reaching 100% of our GDP this year. And as you're implying (I think), it can take a drastic swing if a fragile economy starts to cave. So, I think that may be the point he's trying to make.But see now you are trying to change the subject. Remember that I stated that as long as it stays in line with the GDP it's not a problem right? If it was 90% of the budget then it would certainly be a problem. However, that would mean that we haven't kept it in step with the GDP like I stated.

Larkin believes that the left wants to destroy the constitution, the SC is in on it and that our country is headed for a dictatorship

I'm sure you're aware that the debt is reaching 100% of our GDP this year. And as you're implying (I think), it can take a drastic swing if a fragile economy starts to cave. So, I think that may be the point he's trying to make.

But see now you are trying to change the subject. Remember that I stated that as long as it stays in line with the GDP it's not a problem right? If it was 90% of the budget then it would certainly be a problem. However, that would mean that we haven't kept it in step with the GDP like I stated.

That's great that you have all these facts and statistics, but I'd appreciate it if you could actually discuss the central thesis of my argument which is "as long as debt remains below a certain percentage of GDP it's not a problem". This is the third post now that you have failed to even address the point.

I personally do not appreciate being insulted in such a way simply because you cannot argue the actual point. I would point out that I am intimately engaged in the financial industry. In fact I'll be starting a job at the world's leading financial company this summer. Just because you read a few things on Ron Paul's website does not make you any more of an expert than the rest of us. It does not make your opinion so "obviously correct", and it does not give you the right to insult my intelligence.

lol... that's cute, but we both know it's the other way around

Your the one insulting everyones intelligence by simply stating all is well "as long as debt remains below a certain percentage of GDP it's not a problem". This is just an untested theory. Stating it as fact is not at all honest and reflects very poorly on you and anything you have to say.

The WWII era debt cannot be likened with todays. There will not be anything like the post war boom to deliver us out of debt. Anyone who argues this is blowing smoke out their hole. That time was very different from today in so many categories. Economists can say very little for certain, all they can do is guess. That is the bottom line, All they can do is guess based on an imperfect models and assumptions. How will you know who is right? You won't, not unless an economic disaster happens and blame is obvious.

Certain things can be said that could happen. If the rates on the T-Bills start to rise, so does the interest we have to pay on the debt. That's right, if the rates go up so will our debt interest payment. This can happen very fast due to the size of the debt and the extremely low current rates. Say if the rates double from the current <0.2% to 0.4%, the interest will double. So what would happen if it jumps to 1.0% or 2.0%? Do the math and you come up with crazy huge numbers that will cause the debt to sky rocket.

so then what the hell am I supposed to blame?Religious belief is a decision made by a person. Therefore blaming the belief is backwards.

Yeah, but when you are shopping at Wal-Mart(therefore buying cheap Chinese goods) you are being a bad American and hurting the American economy. Basically you are giving your money to China, when you could of bought something American. Them deflating their currency is because they want it cheap. They aren't hurting themselves. This is all part of the short sighted American view of the world. It seems great today, but we are digging a grave for our future.

When I was a boy, my school held fund-raising fairs. Using dollars, my classmates and I purchased as many fair ‘tickets’ as we wanted. We then used these tickets to buy whatever foods and toys were sold at the fair. Of course, some items cost more tickets than other items. Each ticket, though, exchanged for a fixed number of dollars.

Suppose my school had undervalued its fair tickets – that is, suppose it gave too many tickets in exchange for each dollar. (Or, put differently, suppose my school had demanded in return for each fair ticket too few dollars.) Who’d be harmed? The answer is my school. By undervaluing its tickets, my school would have sold its fair items at prices below cost. Its revenue at the end of the day would have been lower than its costs. Rather than raising money, my school would have lost money – and we students would have been made wealthier as a result!

The same holds true for China. If the yuan is undervalued, you can be sure that this policy drains wealth from China rather than builds wealth there – and makes Americans richer in the process.

Sincerely,

Donald J. Boudreaux

When the US pays for Chinese exports (and it purchases much as China still maintains a large trade surplus with the US), it does so by purchasing Yuan (using Dollars) on the foreign exchange market (see *Note: below). This results in a rising Yuan ... which makes sense since a net trade surplus results in net demand for the net trade surplus currency (in this case, the Yuan). But the Chinese want to keep their export sector growing (they are still an export driven economy) and this will not happen with continued growing strength in the Yuan (trade would eventually balance back as Chinese exports to the US become more expensive and Chinese imports from the US less expensive), especially relative to the US Dollar. So, the Chinese central bank intervenes and creates ("prints") Yuan to buy US Dollars. This artificially devalues the Yuan and provides an artificial boost to the Chinese export sector (keeping the value of their currency lower than it would normally be without the intervention). This is why the Chinese central bank has so many US Dollar denominated foreign reserves ... they created them. Now that they have created them, they are stuck trying to determine the best investment choice for them. It was once a mix of US treasuries, Agency MBSs, and Agency debt. But with the nationalization of the Agencies (Fannie Mae, Freddie Mac, etc.), China has shifted the majority of its US dollar denominated foreign reserves to US treasuries.

So on one side, you have the US complaining (legitimately) about the Chinese manipulating their currency. But in the same breath, the US is lobbying for more investment in its debt (sorry, cannot have it both ways) as the amount of debt issuance required of the US Treasury has grown to unsustainable levels.

On the other side, you have the Chinese complaining (legitimately) about the US devaluing its currency and making Chinese investments in US Dollar denominated assets less stable. But in the same breath, the Chinese continue to print Yuan to buy Dollars due to their trade surplus and their desire to artificially support their export sector. The Chinese can solve their own problem by not printing Yuan to buy Dollars (devaluing their currency relative to the Dollar). But like the US, they want it both ways.

*Note: Even if a Chinese exporter accepts US Dollars without first converting to Yuan, the result is still the same ... these Dollars will be subsequently exchanged for Yuan on the foreign exchange market.